We depend so much on technology that we sometimes take it for granted. I found myself in that position for the last two weeks as my wife and I took a two-week river cruise from Amsterdam to Budapest. The shore excursions were fascinating and we couldn’t have asked for better weather. The only challenge was limited internet access hampered by mountains and the 62 river locks we went through. I think this was the first time in the 12 years I’ve been writing my weekly market commentary that I couldn’t complete it. Thanks for your understanding.

One thing I was amazed at during our travels, was the amount of construction taking place in Europe. Cranes dominated the skyline in many major cities like Amsterdam, Cologne, Munich, Nuremberg, Vienna and Budapest. As Europe recovers from the effects of the pandemic, their economies appear to moving full speed ahead.

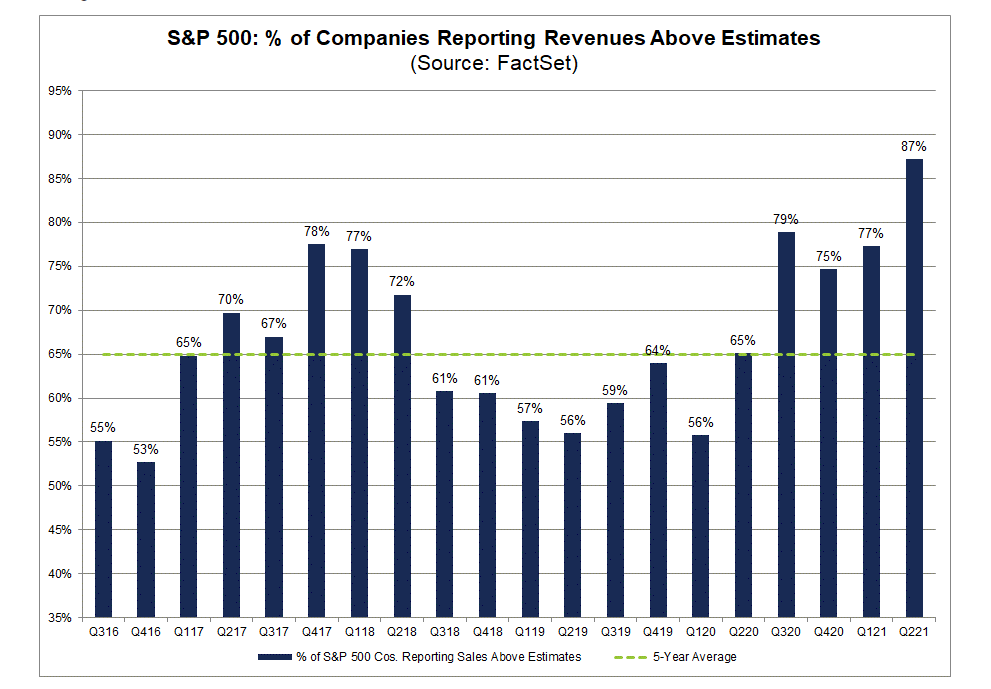

Strong earnings continue to fuel growth in the stock market. The chart below from FactSet shows that 87% of S&P 500 companies reported revenue above analysts estimates for the second quarter. I continue to be bullish on the U.S. economy and stock market. As I have said before, the only challenge right now is keeping the recent surge in Covid cases under control. Unfortunately, cases continue to rise and hospitals are facing challenges not seen since last summer. If you have any questions, please contact me.

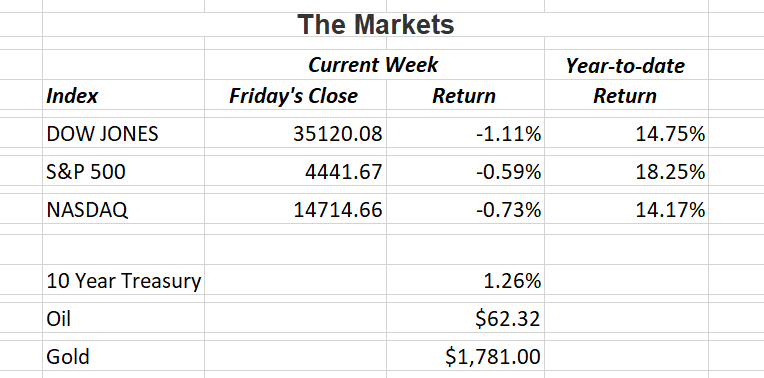

The Markets and Economy

- Bottlenecks in the shipping industry were compounded last week as a major container terminal in China’s Ningbo-Zhoushan Port remained shut after a case of Covid-19 was reported the prior week. The result will have a cascading effect to other ports further straining their operations. About 10% of the global container capacity is stacked on ships stuck outside ports according to one shipping official.

- Chinese stocks continued their slide last week as Beijing’s corporate crackdown is far from over. State media commentaries posted articles suggesting regulators plan to get tough on more industries sparking a stock selloff.

- America continues its position as the world’s number one economy. S. gross domestic product rose a strong 12.2% in the second quarter, easily beating China’s number two position with a growth rate of 7.9%.

- Companies continue to sit on a pile of cash. Globally, the record of $6.84 trillion in corporate coffers will likely stay there. According to S&P Global, that figure is 45% higher than the five-year average. Analysts had expected much of that money to be put to work. Unfortunately, continued concern over the sharp spike in Covid-19 cases due to the spread of the Delta variant is causing companies to hoard cash.

- Retail sales fell 1.1% in July from June according to the U.S. Commerce Dept. The figures show consumers spent less on merchandise but increased spending in restaurants.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.